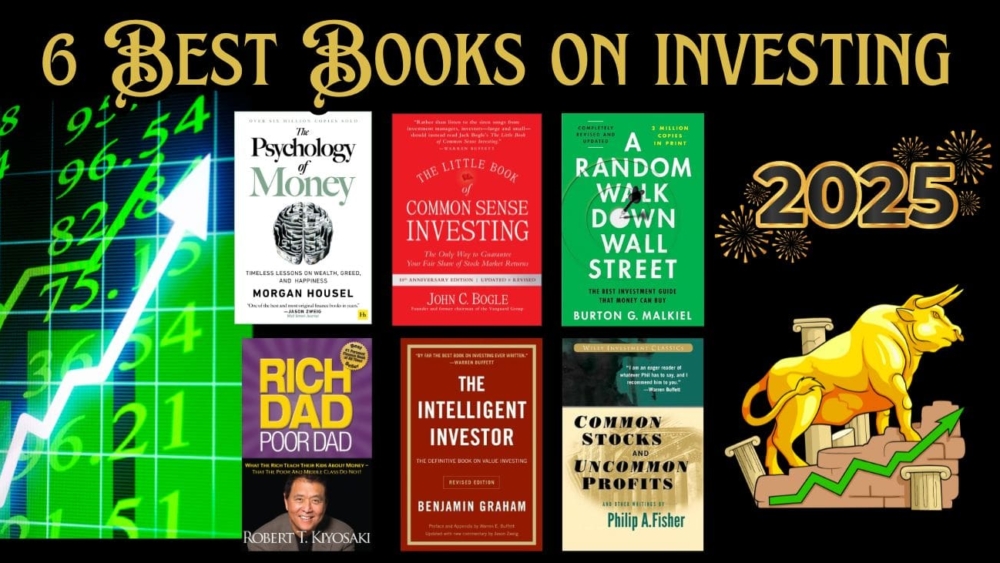

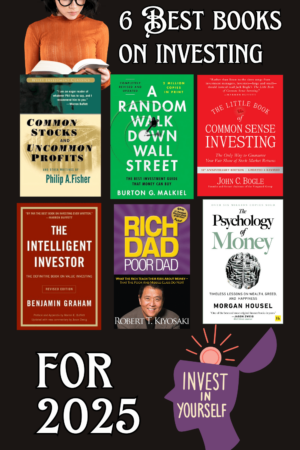

With the new year right around the corner, here are the 6 Best Books on Investing for 2025 for you to read.

Disclaimer: I am not a financial advisor, and the content on this blog is not intended to be financial advice. The information provided is for educational and informational purposes only. Readers seeking financial advice should consult with a qualified financial professional to address their specific needs and circumstances.

Hey! Acorns makes it easy to save and invest. Join me and you’ll get a free $5 investment! As a perk of referring you, I can get a reward too. Learn more and see terms here. https://t.co/pbhd920h8P

— Ana Karen Perez (@AnitasBooklist) December 13, 2024

Investing is as much about knowledge and strategy as it is about discipline and mindset. Whether you’re a beginner or a seasoned investor, the right resources can help. They can provide insights to navigate the complex financial world. Classics like “The Intelligent Investor” and “A Random Walk Down Wall Street” teach market principles. Modern books like “The Psychology of Money” and “Rich Dad Poor Dad” explore the mindsets behind creating wealth. These six must-read investing books provide a complete guide. They explore timeless principles, personal stories, and actionable strategies. They show how to build and sustain financial success.

Here are six investing books, recommended by experts. They suit different experience levels.

1. The Intelligent Investor by Benjamin Graham

-

Why Read It: This classic, the great book of value investing, teaches sound investing and emotional discipline. Warren Buffett credits this book as his greatest influence.

-

Key Takeaway: Focus on long-term, value-based investing and avoid market speculation.

-

Quote: “The individual investor should act consistently as an investor and not as a speculator.”

-

This highlights the importance of long-term thinking and avoiding market speculation.

-

2. A Random Walk Down Wall Street by Burton Malkiel

-

Why Read It: This book explains various investment strategies. It shows why most investors should use a passive approach.

-

Key Takeaway: Embrace diversification and low-cost index funds for steady returns.

-

Quote: “The stock market is filled with individuals who know the price of everything, but the value of nothing.”

-

A reminder to focus on intrinsic value rather than short-term price movements.

-

3. Common Stocks and Uncommon Profits by Philip Fisher

-

Why Read It: Fisher’s insights stress investing in companies with growth potential. Also, understand a company’s management and culture.

-

Key Takeaway: Assess a company’s growth potential and edge. Don’t just look at financials.

-

Quote: “The stock market is filled with individuals who try to buy low and sell high. I believe far more money is made by buying great companies at a fair price and holding on as they grow.”

-

A testament to the power of long-term growth investing.

-

4. The Little Book of Common Sense Investing by John C. Bogle

-

Why Read It: The founder of Vanguard wrote this book. It simplifies investing. It advocates for low-cost index funds to build wealth over time.

-

Key Takeaway: Use low-cost index funds. They offer market returns with low risk.

-

Quote: “The greatest enemy of a good plan is the dream of a perfect plan.”

-

Encourages investors to stick with simple, proven strategies rather than chasing perfection.

-

5. Rich Dad Poor Dad by Robert Kiyosaki

-

Why Read It: This book isn’t just about stock market investing. It teaches key ideas about money and investing. They lead to financial freedom.

-

Key Takeaway: Get income-generating assets. Adopt a wealth-creating mindset.

-

Quote: “The rich don’t work for money; they make money work for them.”

-

Emphasizing the mindset shift required to achieve financial independence.

-

6. The Psychology of Money by Morgan Housel

-

Why Read It: This modern classic examines how emotions affect financial success. It’s a must-read for understanding the behavioral aspects of investing.

-

Key Takeaway: Financial success requires both knowledge and good behavior. It also needs a long-term view.

-

Quote: “Spending money to show people how much money you have is the fastest way to have less money.”

-

A powerful insight into the role of humility and self-control in financial success.

-

These books suit both beginners and seasoned investors. They offer timeless principles and strategies to grow wealth.

Final Thoughts:

Investing is not a one-size-fits-all journey. It needs a mix of knowledge, patience, and self-reflection. These books’ lessons provide a roadmap. They help to make smart choices and avoid pitfalls. They also align investments with long-term goals. Each book teaches readers to grow their wealth and finance skills. They cover value investing and the psychology of finance. By using these insights, investors can navigate the markets. They can build a strong financial future.

These books give advice and inspiration. They will help you achieve your 2025 financial goals. There are more books on my latest blog post, Personal Finance Books For 2025. For more inspiration, follow me on Pinterest and Goodreads.

Happy reading! 📖

Here’s to a prosperous and financially secure 2025!

Best,

Anita