Setting Yourself Up for Success

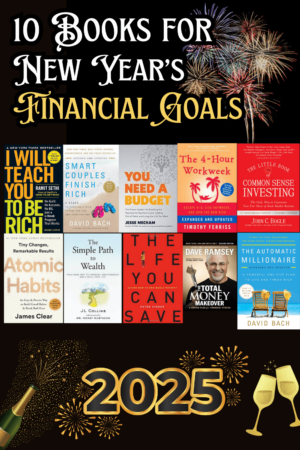

With the new year approaching, it’s time to reflect on your finances and set goals for 2025. Here are 10 Books for New Year’s Financial Goals 2025.

Clear resolutions can guide and motivate you. They help if you want to be financially independent, save for a big purchase, or improve your money skills. Here are some achievable financial goals to consider:

Hey! Acorns makes it easy to save and invest. Join me and you’ll get a free $5 investment! As a perk of referring you, I can get a reward too. Learn more and see terms here. https://t.co/pbhd920h8P

— Ana Karen Perez (@AnitasBooklist) December 13, 2024

Disclaimer: I am not a financial advisor, and the content on this blog is not intended to be financial advice. The information provided is for educational and informational purposes only. Readers seeking financial advice should consult with a qualified financial professional to address their specific needs and circumstances.

1. Build or Strengthen Your Emergency Fund

Book Recommendation: The Automatic Millionaire by David Bach

This book stresses the power of automating your finances. It can help you save for goals, like an emergency fund.

If you don’t already have an emergency fund, 2025 is the year to start one. Aim to save three to six months’ worth of essential living expenses. This fund will cover unexpected costs, like medical bills, car repairs, or job loss.

Action Tip: Set up automatic transfers to a high-yield savings account. This will let you contribute consistently, with no extra effort.

2. Pay Down Debt

Book Recommendation: The Total Money Makeover by Dave Ramsey

A step-by-step guide. It outlines strategies, like the debt snowball, to eliminate debt and gain freedom.

High-interest debt can weigh heavily on your financial health. Resolve to tackle it aggressively this year. Pay off credit cards, personal loans, or student loans. Use methods like the debt snowball or debt avalanche. The first pays the smallest debts first. The second focuses on high-interest debts.

Action Tip: Make extra payments when possible. Also, consider refinancing or consolidating for lower rates.

3. Create or Refine a Budget

Book Recommendation: You Need a Budget by Jesse Mecham

This book complements the popular YNAB budgeting system. It teaches you to give every dollar a job and take control of your money.

A budget is your blueprint for financial success. If you don’t have one, track your income and expenses. This will help you understand where your money goes. Allocate funds toward needs, wants, savings, and debt repayment.

Action Tip: Use budgeting apps or spreadsheets to streamline the process. Review your budget monthly to stay on track.

4. Save for Retirement

Book Recommendation: The Simple Path to Wealth by JL Collins

A simple guide to gaining financial independence. It covers saving, investing, and retirement planning.

It’s never too early or too late to plan for retirement. Maximize contributions to your 401(k), IRA, or other retirement accounts. If your employer offers a match, make sure you’re contributing enough to take full advantage.

Action Tip: Increase your contributions by 1-2% this year. Also, consider low-cost index funds to grow your investments.

5. Invest for the Future

Book Recommendation: The Little Book of Common Sense Investing by John C. Bogle

The founder of Vanguard wrote this book. It shows the value of low-cost index funds for long-term investing. They are key to success.

Expand your financial portfolio by exploring investment opportunities. Choose investments that match your goals and risk tolerance. Options include stocks, bonds, real estate, and mutual funds.

Action Tip: If you’re new to investing, ask a financial planner for help.

6. Increase Your Income

Book Recommendation: The 4-Hour Workweek by Timothy Ferriss

A modern classic for anyone who wants to improve their work life, start a side hustle, or build a money-making business.

Boosting your earnings can fast-track your financial goals. Seek chances to negotiate a raise, start a side hustle, or learn skills for better-paying jobs.

Action Tip: Set realistic income targets and track your progress throughout the year.

7. Learn More About Personal Finance

Book Recommendation: I Will Teach You to Be Rich by Ramit Sethi

A fun, no-nonsense take on personal finance. It covers budgeting to investing in an engaging, practical way.

Education is key to making informed decisions about your money. Learn more about personal finance topics. Focus on investing, taxes, and estate planning.

Action Tip: Read a new finance book each quarter. Attend workshops, or follow reputable financial blogs and podcasts.

8. Set a Specific Savings Goal

Book Recommendation: Smart Couples Finish Rich by David Bach

This book is ideal for saving toward shared goals, like a house or vacation. It offers a roadmap for financial planning with a partner.

Whether you’re saving for a vacation, a down payment on a house, or a big purchase, define your goal clearly. Break it down into smaller milestones to make it more manageable.

Action Tip: Open a separate savings account for each major goal. This will keep your funds organized and track your progress.

9. Give Back

Book Recommendation: The Life You Can Save by Peter Singer

This book argues for effective giving. It explores its philosophy and strategies.

If you are financially stable, consider adding charity to your resolutions. Donating to causes you care about can be fulfilling. It also helps your community.

Action Tip: Set a percentage of your income for charity or volunteer your time.

10. Review and Adjust Your Goals Regularly

Book Recommendation: Atomic Habits by James Clear

Though not about finances, this book offers a strong way to build habits and stay consistent with your goals, including financial ones.

Life is unpredictable, and your financial goals may need to evolve. Schedule regular check-ins. Monthly or quarterly will work. They will help you assess your progress and adjust as needed.

Final Thoughts

Setting financial goals for 2025 can help you. It can improve your habits, reduce stress, and lead to success. Remember, progress is more important than perfection. Celebrate all your wins, big or small. Stay committed to your resolutions all year.

These books give advice and inspiration. They will help you achieve your 2025 financial goals. There are more books on my latest blog post, Personal Finance Books For 2025. For more inspiration, follow me on Pinterest and Goodreads.

Happy reading! 📖

Here’s to a prosperous and financially secure 2025!

Best,

Anita